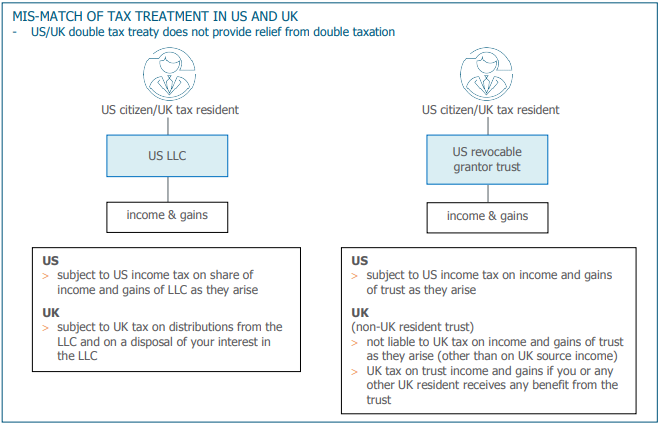

Akshata Murty's non-dom status is a choice not an obligation – tax experts | Tax and spending | The Guardian

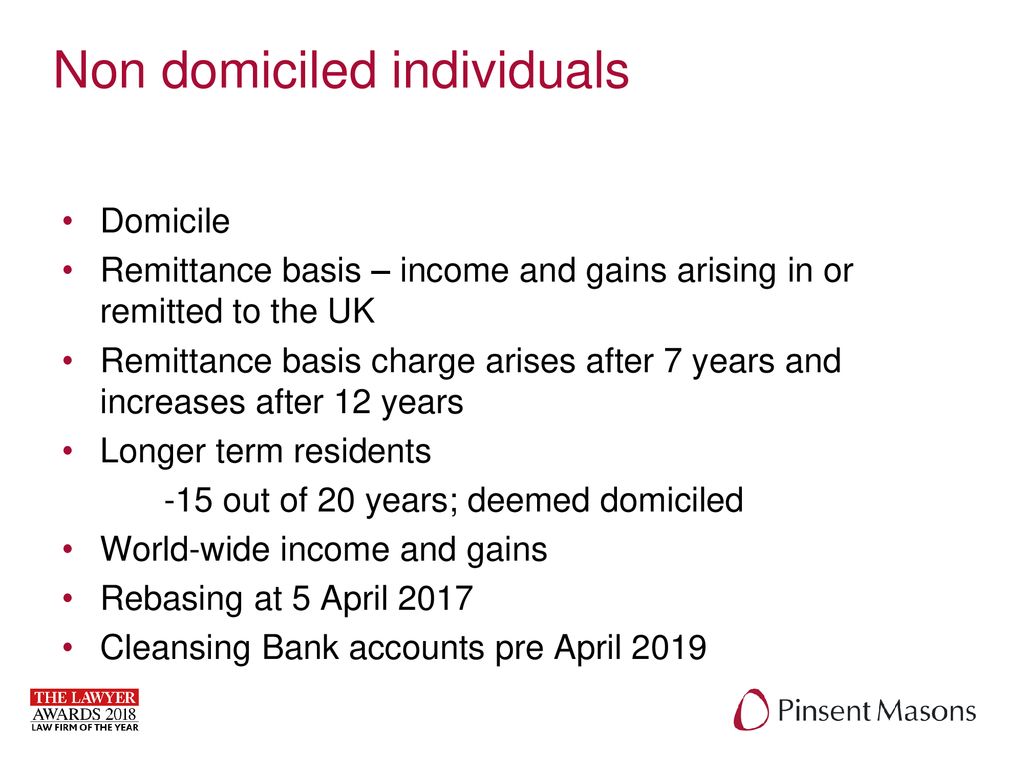

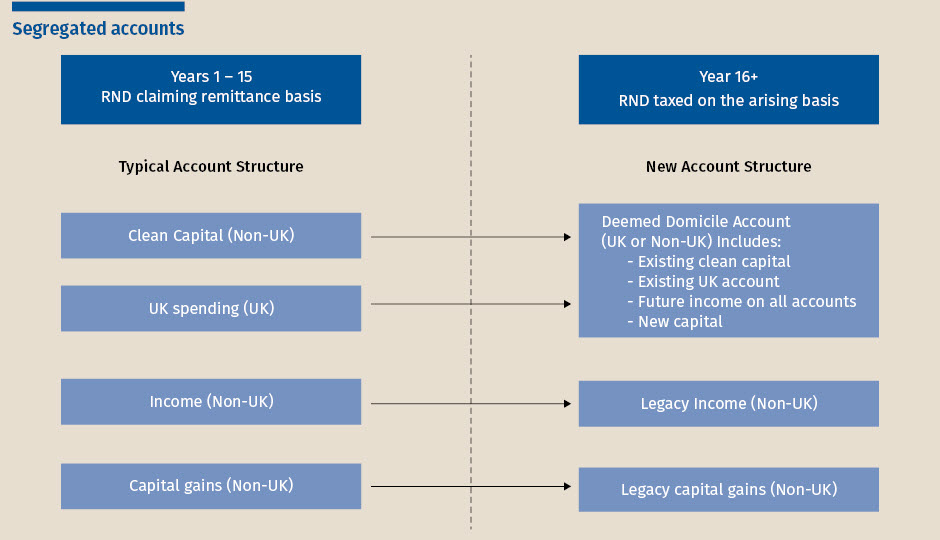

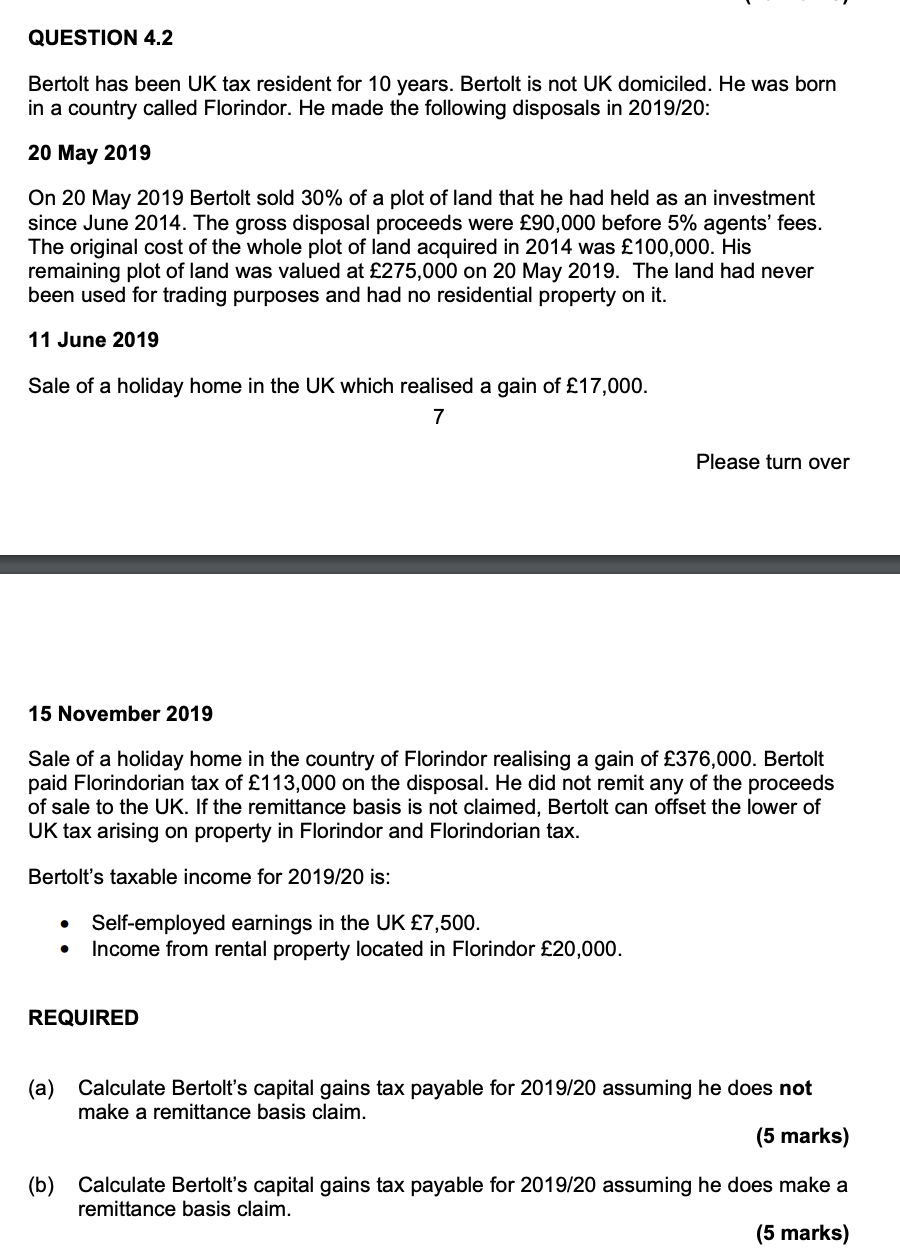

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Politax on Twitter: "It really isn't worth 10 seconds of your time. @fullfact or @bbcrealitycheck might want a look though." / Twitter