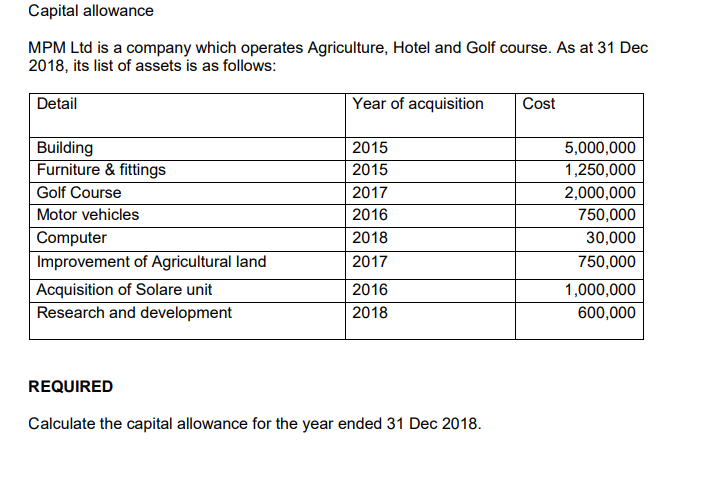

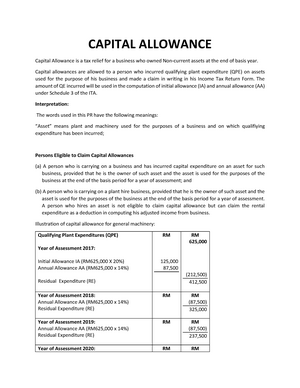

Notes - Capital Allowance - CAPITAL ALLOWANCE Capital Allowance is a tax relief for a business who - Studocu

taxes - Capital allowance and balancing charges on UK tax return - Personal Finance & Money Stack Exchange

Notes - Capital Allowance - CAPITAL ALLOWANCE Capital Allowance is a tax relief for a business who - Studocu

Tax implications of financial arrangements for motor vehicles When a company needs a motor vehicle, it can choose to either purc

.png)

CT600: How do I enter a balancing charge/allowance on disposal of a capital allowance asset. - Knowledge Base

.png)