AASB 112 – I MKT W Legislation has recently been passed by Parliament that changes the rules for accessing the reduced corpora

Base rate entity eligibility tests worksheet (bre) - PS Help: Tax - Australia 2019 - MYOB Help Centre

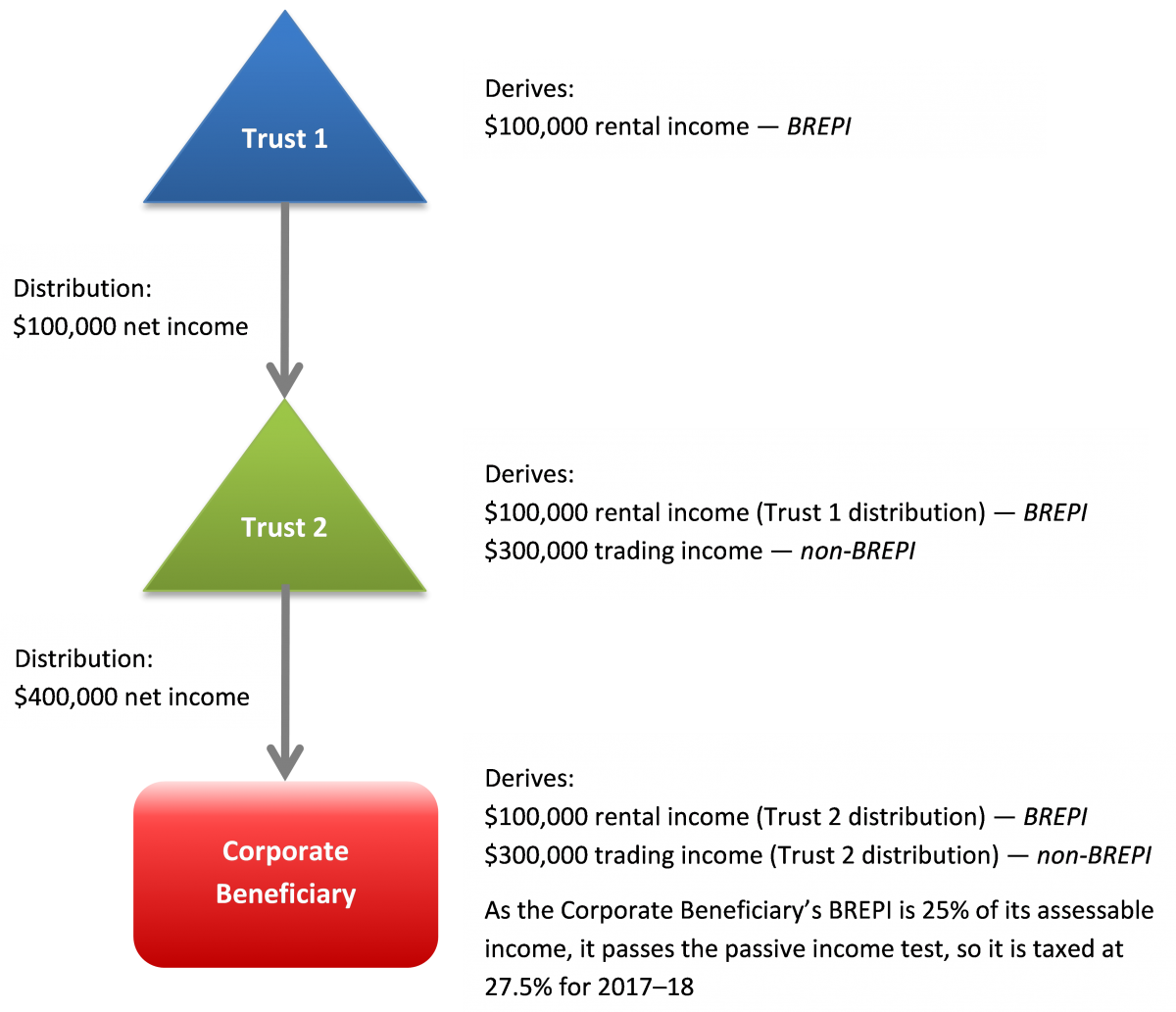

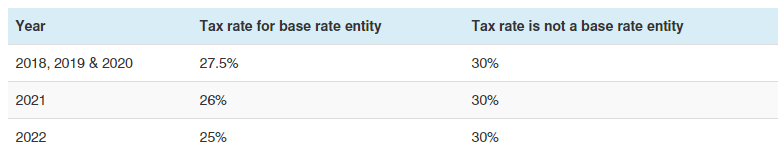

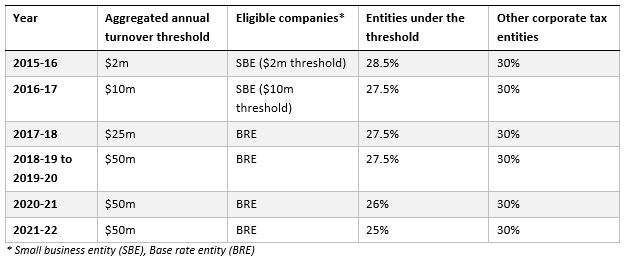

Base Rate Entity concept explained: How to get a 27.5% tax rate? | A "Base Rate Entity" pays tax 27.5% instead of 30%. Find out how it works and if your business

Base Rate Entity concept explained: How to get a 27.5% tax rate? | A "Base Rate Entity" pays tax 27.5% instead of 30%. Find out how it works and if your business