programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

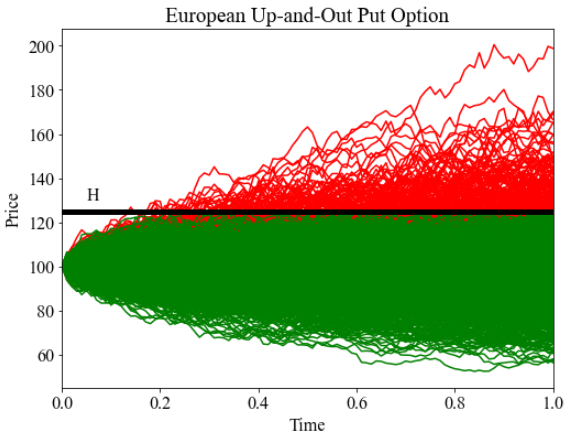

GitHub - LoweLundin/Pricing-of-Barrier-Option-Monte-Carlo: Using Monte Carlo methods to price Up-And-Out barrier option

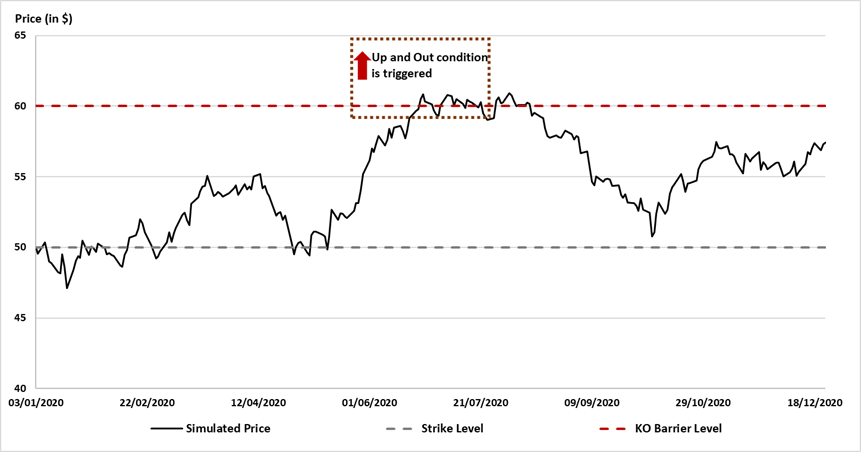

Option Pricing using Monte Carlo Simulation - Pricing Exotic & Vanilla Options in Excel - Introduction - FinanceTrainingCourse.com

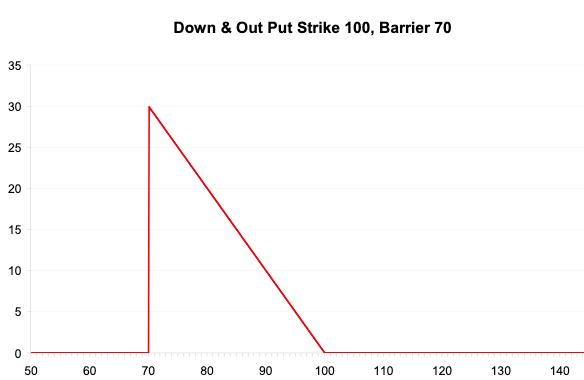

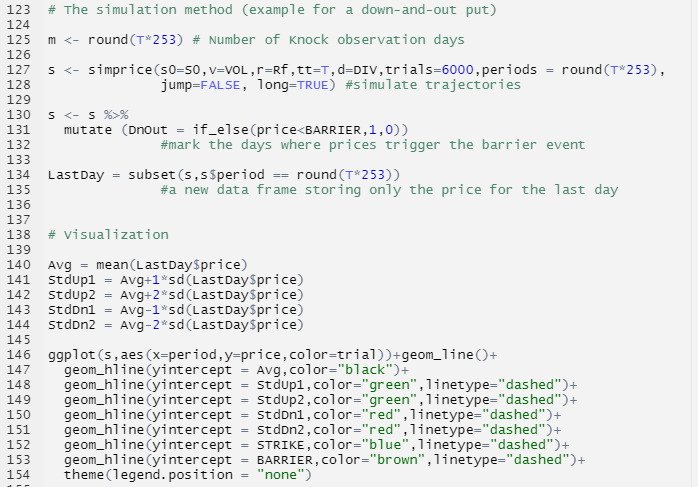

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

USING MONTE CARLO SIMULATION AND IMPORTANCE SAMPLING TO RAPIDLY OBTAIN JUMP-DIFFUSION PRICES OF CONTINUOUS BARRIER OPTIONS 1. In

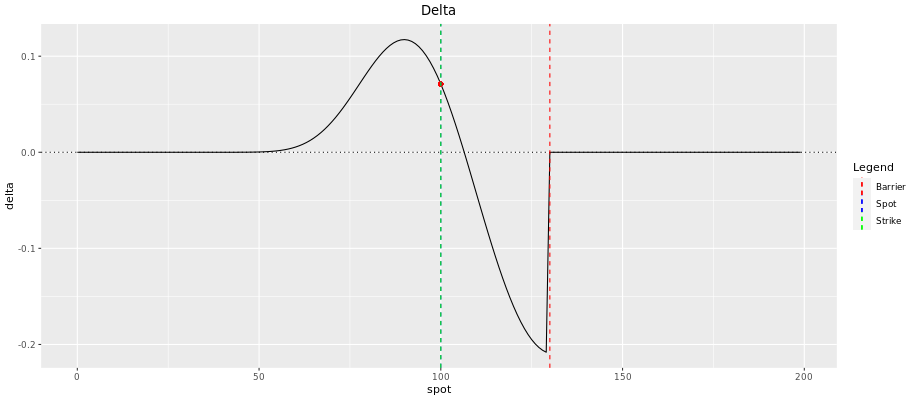

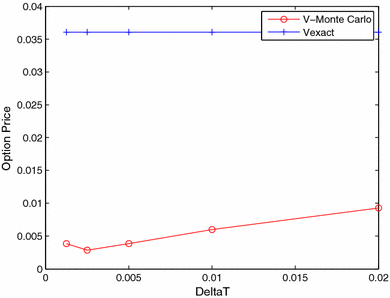

programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

TensorFlow meets Quantitative Finance: Pricing Exotic Options with Monte Carlo Simulations in TensorFlow | Jupyter notebooks – a Swiss Army Knife for Quants

![PDF] Pricing Barrier Options using Monte Carlo Methods | Semantic Scholar PDF] Pricing Barrier Options using Monte Carlo Methods | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/542f6e1e9338632e3bc5b56dad2515854e34190f/25-Table1-1.png)

![PDF] EFFICIENT MONTE CARLO ALGORITHM FOR PRICING BARRIER OPTIONS | Semantic Scholar PDF] EFFICIENT MONTE CARLO ALGORITHM FOR PRICING BARRIER OPTIONS | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3b2e538f515f2e9974143b7137e41473b59af0bb/8-Figure1-1.png)

![PDF] EFFICIENT MONTE CARLO ALGORITHM FOR PRICING BARRIER OPTIONS | Semantic Scholar PDF] EFFICIENT MONTE CARLO ALGORITHM FOR PRICING BARRIER OPTIONS | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3b2e538f515f2e9974143b7137e41473b59af0bb/8-Figure2-1.png)

![PDF] Pricing Barrier Options using Monte Carlo Methods | Semantic Scholar PDF] Pricing Barrier Options using Monte Carlo Methods | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/542f6e1e9338632e3bc5b56dad2515854e34190f/27-Table2-1.png)